Ten less discussed key moments in the story of climate change

Everyone in the climate change space knows the big dates. The first report to coin the term ESG in 2004. ‘An Inconvenient Truth’, Al Gore’s ground-breaking documentary about global warming, airing in 2006. The Paris Agreement in 2015.

But there are so many more important, interesting and fun moments in this story, and those of us working in this space need to keep our audience engaged in the re-telling.

So here are ten of the lesser discussed dates in the world of climate change, which are all hugely important in their own right. I hope that you might find them useful.

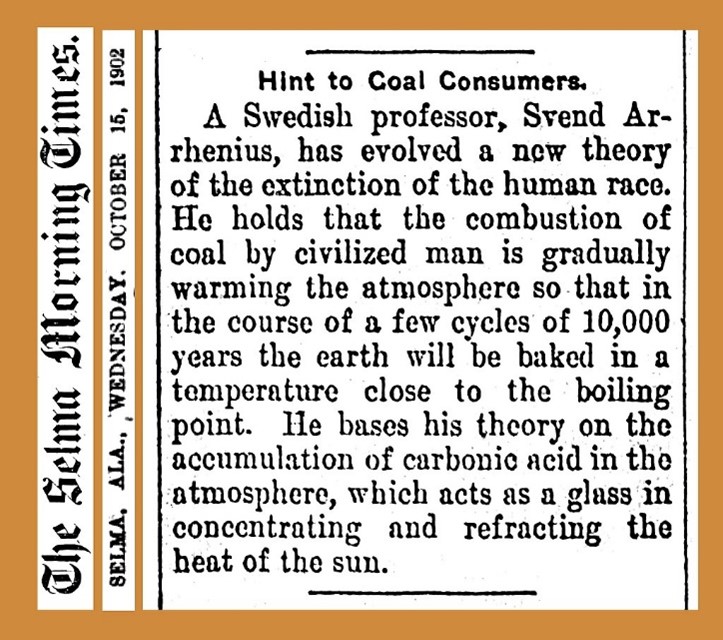

10 -– Science Notes and News – August 1912

Whilst discussions about global warming have only become common in the last thirty or so years, scientists have been studying the way that the earth’s climate has changed over time for several hundred years.

Much of the earliest debate was about the impact of glaciers on the landscape, with scientists suggesting as early as the 1800s that ice once covered much of the northern hemisphere. Fast forward to the 1900s, and researchers were already seeking to understand the way that different gasses can trap heat.

It was a Swedish scientist called Svante Arrhenius (1859-1927) who first figured out that carbon dioxide could have a warming effect, and warnings about the impact of excessive combustion of coal started appearing in journals and newspapers at the beginning of the 20th century:

By 1912 the science was becoming more developed; this note published in the Rodney and Otamatea Times expressed in a simple and measurable way the impact of burning coal on what is now simply referred to as global warming.

Both images sourced via Wikipedia

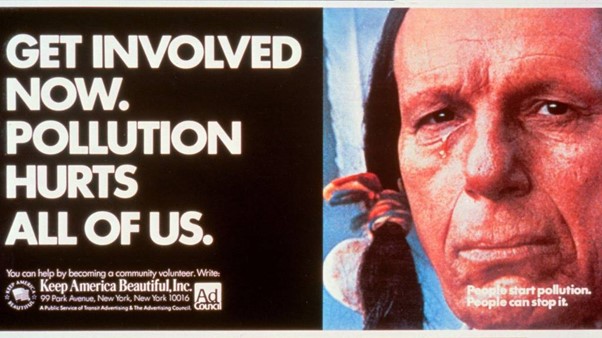

9 – The ‘Crying Indian’ advert aired for the first time – 1971

Argued to be one of the first mainstream disinformation campaigns in relation to environmental matters, the ‘Crying Indian’ advert is infamous in the world of advertising.

The ostensible purpose of the advert was to put a spotlight on pollution, and the role that each of us can play by sensibly disposing of waste.

The real purpose behind the advert was more sinister. Hot off the heels of the first Earth Day protests in America in 1970, the issue of throw-away containers was gaining prevalence in the American political space. These protests held industry, rather than individuals, responsible for the explosion of throw-away packaging that was becoming increasingly visible in America, and new laws – particularly in relation to reusable bottles – seemed like they might be on their way to tackle the problem.

This would have created a huge burden on the beverage and packaging industries, who worked behind the scenes to change the narrative – essentially by shifting blame for pollution away from the corporations and onto individuals. Enter the Crying Indian, whose tearful eye at the sight of rubbish being thrown from a car window brilliantly made the issue of pollution one of individual, rather than corporate responsibility – an approach that companies around the world continue to take in their marketing communications to this day.

Needless to say no bottle bill – or other such regulations – were ever passed in America. But eventually those involved in the environmental movement realised what had really been behind the Crying Indian advert, arguably the most effective advert ever produced to block progress on environmental issues.

A Keep America Beautiful advertisement by the Ad Council, which was launched in 1971. (Ad Council) – Original Credit: (HANDOUT)

8 – Two Cars in Every Garage and Three Eyes on Every Fish – November 1990

On 1 November 1990, the fourth episode of the second season of ‘The Simpsons’ aired on the Fox network in America.

It is hard to quantify in an empirical way the effect that The Simpsons has had on public perceptions of the nuclear industry, but there are many reasons to think that this show has had a significant impact over the years.

Homer Simpson works as a safety inspector at Springfield’s nuclear power plant. He is frequently portrayed as lazy and incompetent; the show’s opening credits show him accidentally dropping a nuclear fuel rod down the back of his shirt, and then tossing it out the car window on his drive home! The plant, in turn, is owned by the unabashedly evil and greedy Montgomery Burns, who is intended to personify everything bad about capitalism.

This episode, named “Two Cars in Every Garage and Three Eyes on Every Fish” particularly stands out. It opens with Bart Simpson pulling a three-eyed fish out of a river downstream from the nuclear plant, in front of a local journalist. The resulting media storm leads to an inspection of the nuclear plant, during which hundreds of safety violations are noted by the inspectors. When Mr Burns is unable to bribe his way out of the situation, he uses his wealth to run for State Governor, in the hope of changing the regulations which threaten to shut his plant down. The imagery and narrative of a dangerous and badly run nuclear plant, owned by a corrupt man with political ambitions, chimed nicely with the messaging being promoted by the anti-nuclear power lobby of the time (remember that the disaster at Chornobyl had occurred only four years earlier).

At Gen-R Law we are proponents of nuclear power, but we will save a fuller discussion of that topic for a different occasion. For now, just remember. If you are telling the story of nuclear power, don’t forget about The Simpsons!

7 – The birth of the ‘Carbon Footprint’ – 2004

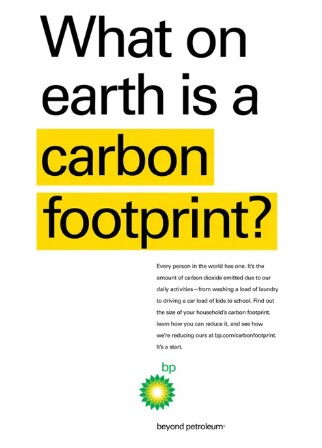

Beginning in 2004, BP ran a series of adverts which brought into mainstream parlance the concept of a personal carbon footprint. The idea, ostensibly, was to help people understand how much CO2 their lifestyle was generating, thereby empowering consumers to reduce that footprint if they wished.

Whilst there was a veneer of corporate responsibility to the concept of a personal carbon footprint, with the benefit of hindsight this campaign is now often spoken of in the same vein as the Crying Indian advert.

Environmentalists argue that the concept of the carbon footprint was little more than a cynical attempt by BP to divert attention away from the responsibility of the businesses involved in producing oil, onto the individuals who were consuming the oil. It made the resulting CO2 emissions our responsibility as consumers, rather than something for which the oil and gas companies should be required to account.

One of the adverts run by BP between 2004 and 2006

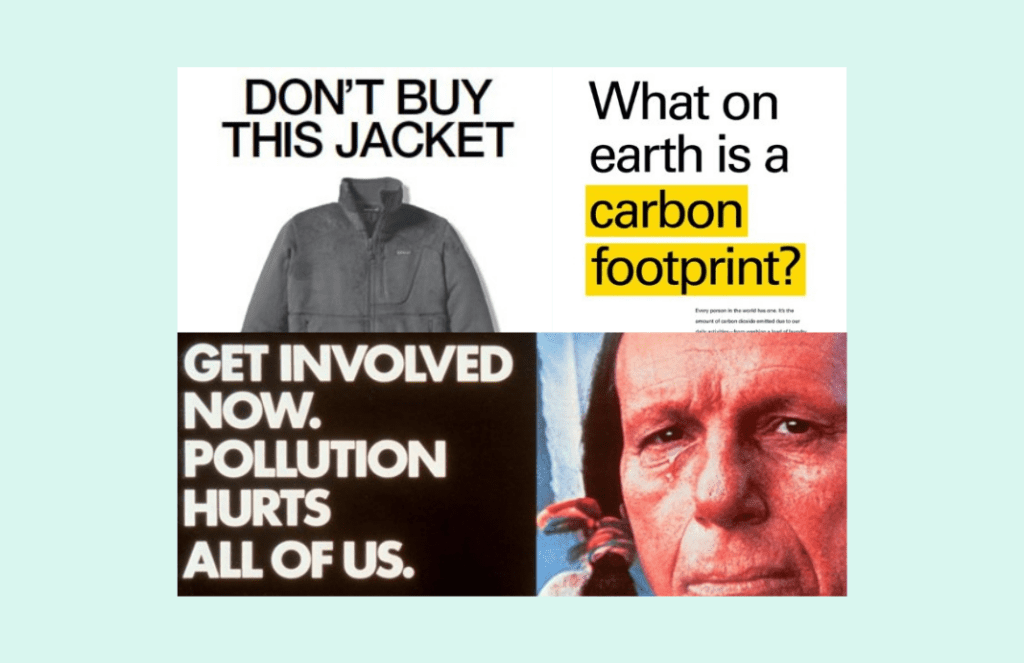

6 – Patagonia – ‘Don’t Buy This Jacket’ – November 2011

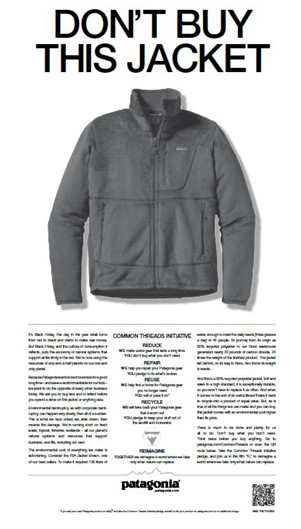

When it comes to leading the way on environmental issues, few companies are more inspiring than Patagonia. What started as a small workshop making climbing equipment became one of the world’s leading outdoors clothing brands and a case study on the power of corporate responsibility.

Many were cynical about Patagonia’s ‘Don’t buy this Jacket’ campaign, which opens with the following text:

“It’s Black Friday, the day in the year retail turns from red to black and starts to make real money. But Black Friday, and the culture of consumption it reflects, puts the economy of natural systems that support all life firmly in the red. We’re now using the resources of one-and-a-half planets on our one and only planet.

Because Patagonia wants to be in business for a good long time – and leave a world inhabitable for our kids – we want to do the opposite of every other business today. We ask you to buy less and to reflect before you spend a dime on this jacket or anything else.”

Unsurprisingly the advert caught people’s eyes, and sales boomed at Patagonia. But they had made a powerful point and an important offer – to repair any Patagonia gear that might get broken, help customers find a new home for any gear that they no longer need, and a guarantee to take back any items that were worn out so that they could be recycled. This was one of the earliest examples of what is now broadly caught under the banner of a ‘circular economy’, and a powerful reminder of how a genuine focus on doing right by the planet can also be good for business.

Patagonia advertisement from the Friday, 25 November 2011 edition of The New York Times

5 – Larry Fink’s first letter to CEO’s which explicitly referenced ESG – January 2016

Larry Fink is the Chairman and CEO of BlackRock, the largest asset management company in the world, with in excess of 9 trillion USD of assets under management in 2023.

Since 2012, Mr Fink has written an annual letter to CEOs, setting out what BlackRock looks for when investing or voting on shareholder resolutions. Whilst previous letters had emphasised the importance of good governance, it was not until 2016 that Mr Fink explicitly used the term ESG, helping propel it into mainstream use amongst the global business community:

“Generating sustainable returns over time requires a sharper focus not only on governance, but also on environmental and social factors facing companies today. These issues offer both risks and opportunities, but for too long, companies have not considered them core to their business – even when the world’s political leaders are increasingly focused on them, as demonstrated by the Paris Climate Accord. Over the long-term, environmental, social and governance (ESG) issues – ranging from climate change to diversity to board effectiveness – have real and quantifiable financial impacts.

At companies where ESG issues are handled well, they are often a signal of operational excellence. BlackRock has been undertaking a multi-year effort to integrate ESG considerations into our investment processes, and we expect companies to have strategies to manage these issues.”

Source: https://www.blackrock.com/corporate/investor-relations/2016-larry-fink-ceo-letter

Whilst he has now stopped using the term ESG in his letters because of the unfortunate politicisation of the term, it is hard to overstate the impact that Mr Fink’s first reference to ESG in his 2016 letter had in mobilising businesses all around the world to pay proper attention to these issues.

4 – The first commercial carbon capture plant came online – June 2017

In June 2017, Swiss company Climeworks switched on the world’s first commercial direct air carbon capture plant. That plant was designed, at that time, to remove 900 tons of CO2 from the atmosphere annually.

Fast forward to 2024 and Carbon Capture is big business, with governments around the world backing significant research and scaling up of the technology, and many businesses relying upon carbon capture as a key part of their net-zero strategies. According to the International Energy Agency, there are currently around 40 commercial facilities in operation applying carbon capture, utilisation and storage (CCUS) to industrial processes, with another fifty or so projects planned around the world.

The IEA acknowledges that current CCUS capacity is a long way behind what is needed to meet the Net Zero Emissions by 2050 scenario. Many parties also regard CCUS as an unwelcome distraction; a technology which, they argue, is not viable as a meaningful solution to the scale of the problem at hand.

3 – Exxon loses board seats to small activist hedge fund – May 2021

Exxon is an energy giant with a market value of around $250 billion USD. This is the story of how a small hedge fund named ‘Engine No. 1’, which held a stake in Exxon worth just $50 million USD (or 0.02%) of Exxon’s shares, unseated three of Exxon’s nominated Board members at their AGM, and replaced them with nominees of their own, in a bid to get Exxon to focus more carefully on reducing its carbon footprint.

The strategy involved getting support from some of Exxon’s biggest institutional investors, BlackRock, Vanguard and State Street, each of whom voted against Exxon’s leadership and backed Engine No. 1. in its proposals. Together, those three shareholders accounted for nearly 20% of the voting shares at Exxon’s AGM, and this extraordinary move from a relatively unknown hedge fund (until that point) made headlines around the world.

This important case in the story of ESG activism demonstrates the ability of relatively unknown shareholders to achieve big things, by bringing the power of large institutional investors to their cause, who are now particularly focused on ESG issues as indicators of long-term sustainable growth potential. With the way having been paved by Engine No 1., it will only be a matter of time before more stories like this find their way into the headlines.

2 – Clarkson’s Farm – June 2021

Love him or hate him, those in the know generally agree. Jeremy Clarkson, and his brilliant show Clarkson’s Farm, has done a huge amount to raise awareness of environmental issues.

When it first aired in June 2021 many people dismissed this show without even watching it, put off by Jeremy’s occasionally antagonistic style, along with his reputation as a petrol head and a motoring journalist. If that is you, please suspend your scepticism for a moment and give this show a go.

Clarkson’s Farm made an extraordinary contribution to the public’s understanding of just how challenging farming has become. Whether documenting Jeremy’s troubles as a result of extreme weather, showcasing the challenges of rearing livestock, or the realities of taking cattle to be slaughtered, this wonderful show brought the true nature of farming to millions of people around the world.

More generally, the show did a huge amount to raise awareness of environmental issues, which Jeremy approaches with a genuine degree of concern. Between efforts to rewild some of his fields, create a pond for fish, provide homes for birds, his bee hives, living fences, or efforts to breathe life back into the undergrowth of the forested areas of his farm, Clarkson’s Farm helped make a range of environmental issues accessible and engaging to new audiences. And for that, this show is to be applauded.

1 – Client Earth sues Shell’s Board of Directors – February 2023

In February 2023, environmental impact organisation Client Earth took the bold and innovative step of buying a handful of shares in the oil giant Shell. They then brought a claim against Shell’s Board of Directors, not in their capacity as concerned members of the public but as shareholders in the company, alleging that the Board had breached their legal duties under the Companies Act 2006 by failing to adopt and implement an energy transition strategy that aligned with the Paris Agreement. This was a legal first for actions of this kind.

Client Earth’s claim had been dismissed, and permission to appeal refused by the High Court. Whilst many in the Legal industry always considered the claim to be ambitious, it does signal an increasing creativity on the part of impact groups like Client Earth when it comes to addressing climate change.

Even if this particular claim has failed, there is no doubt that new claims of this type will be brought in future, this time benefiting from the learnings of this case. More generally, this case signals an increasing willingness of activists to use Court processes to seek to achieve their aims and raise the profile of a particular issue.

Get in touch

We opened our doors on 4 March 2024. As a relatively new firm, we are not yet in a position to offer all of the services described on this website. We have done our best to make clear what we can do now, and what forms part of our exciting plans for the years ahead. We are working hard to make our ambitious vision into a reality.

In the meantime, please do subscribe to receive our regular thought leadership and feel free to follow our journey and progress on LinkedIn.